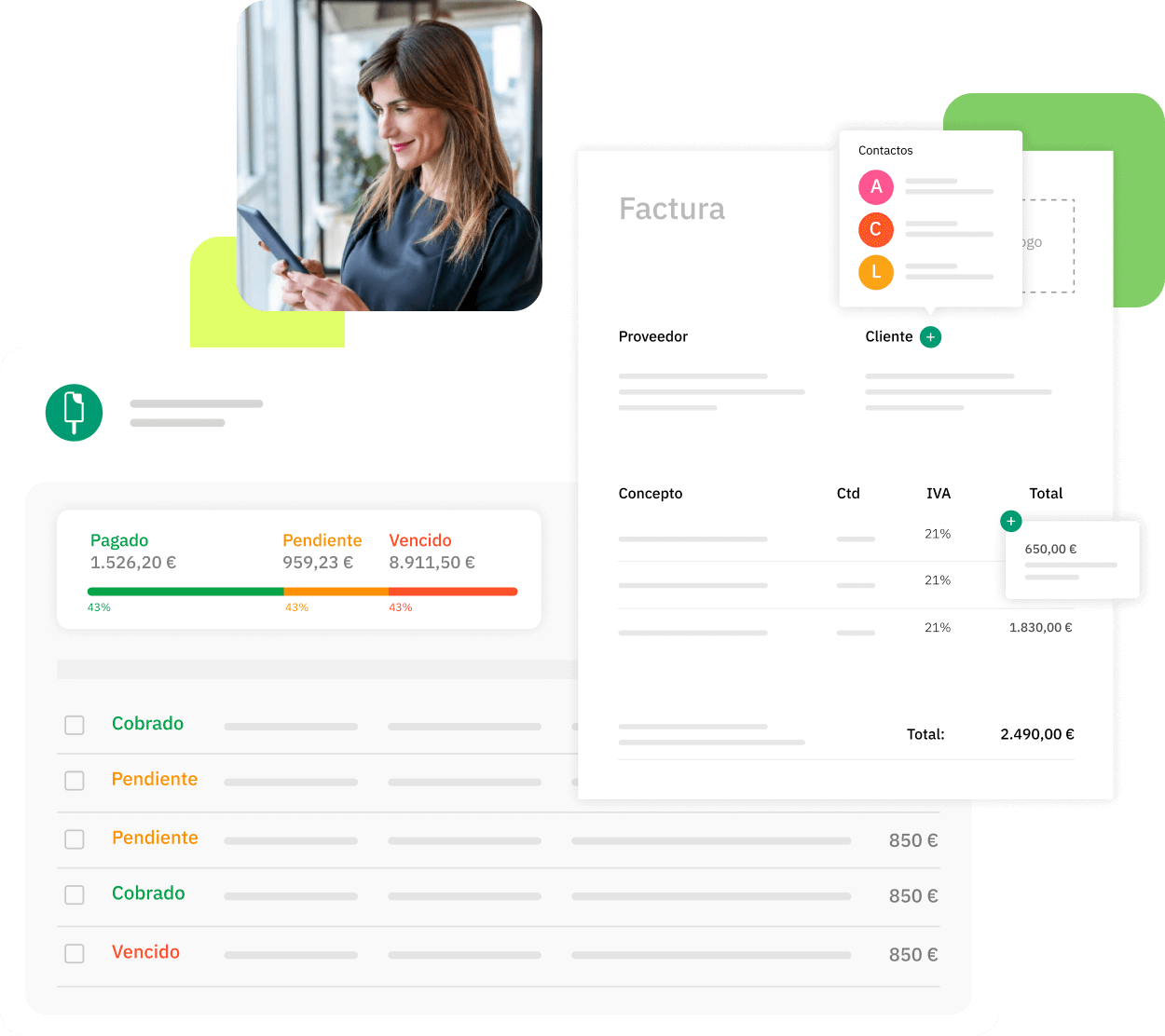

Create free online invoices

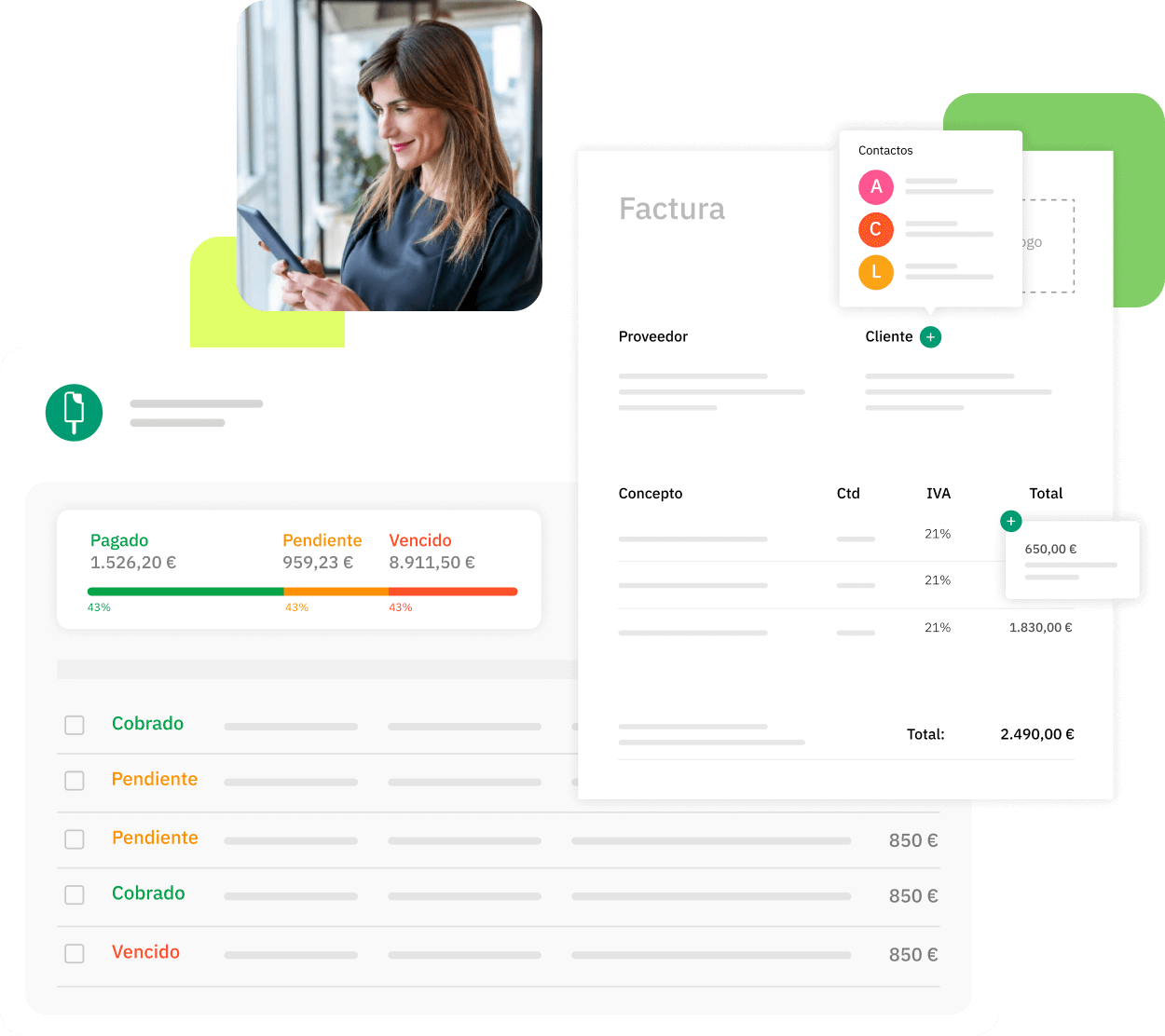

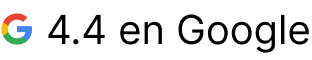

Enjoy complete control over your billing

Forget about spreadsheets and paperwork

Avoid penalties and comply with tax requirements

Turn your invoicing into an easy and simple process

Enjoy complete control over your billing

Forget about spreadsheets and paperwork

Avoid penalties and comply with tax requirements

Turn your invoicing into an easy and simple process

Simple and fast

Generates invoices automatically

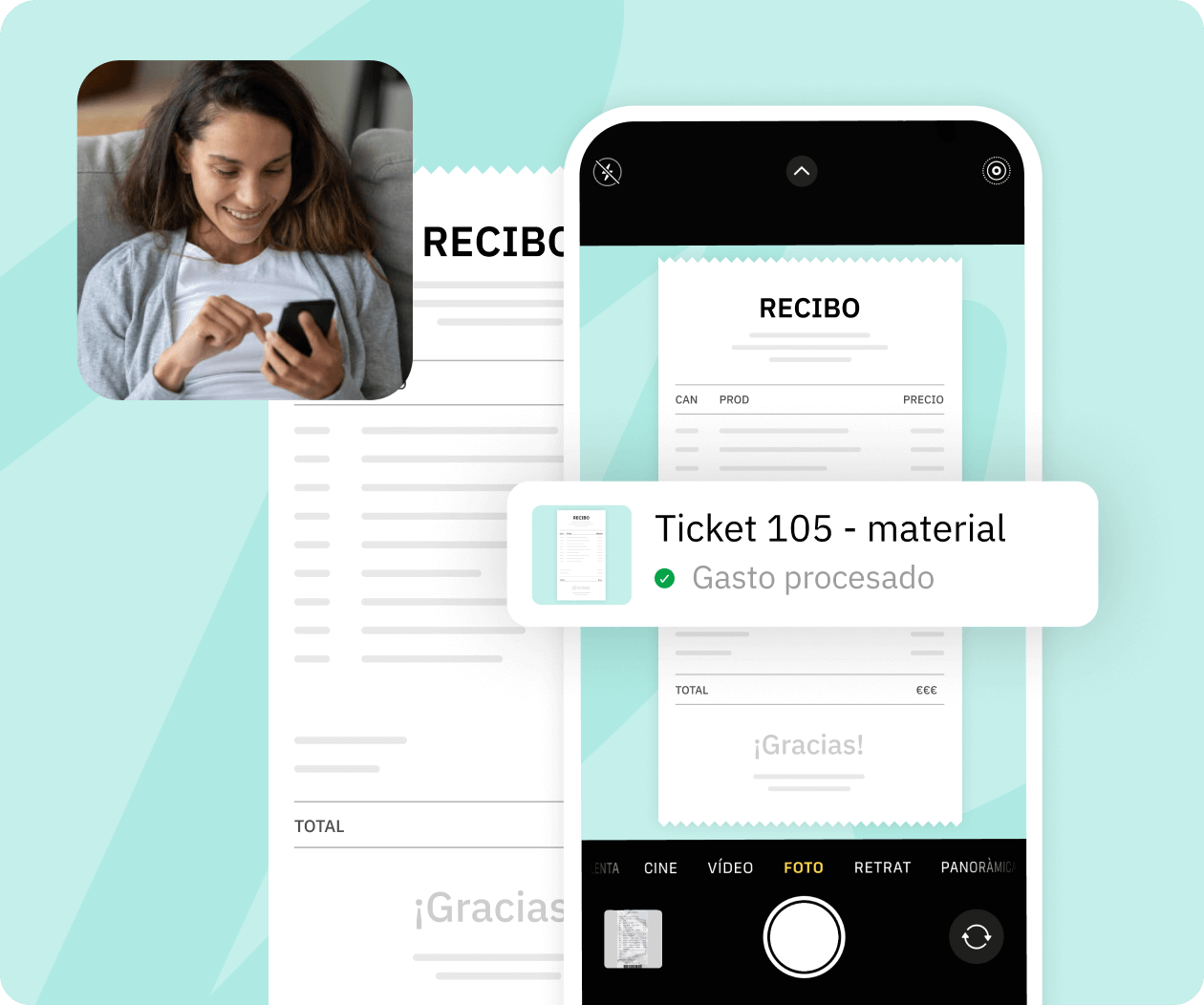

Ordered expenses and receipts

Deduct all your expenses and save on taxes without having to manage paperwork and spreadsheets.

Quipu is the "all-in-one" program to centralize your information and know the status of your business

Automates repetitive tasks

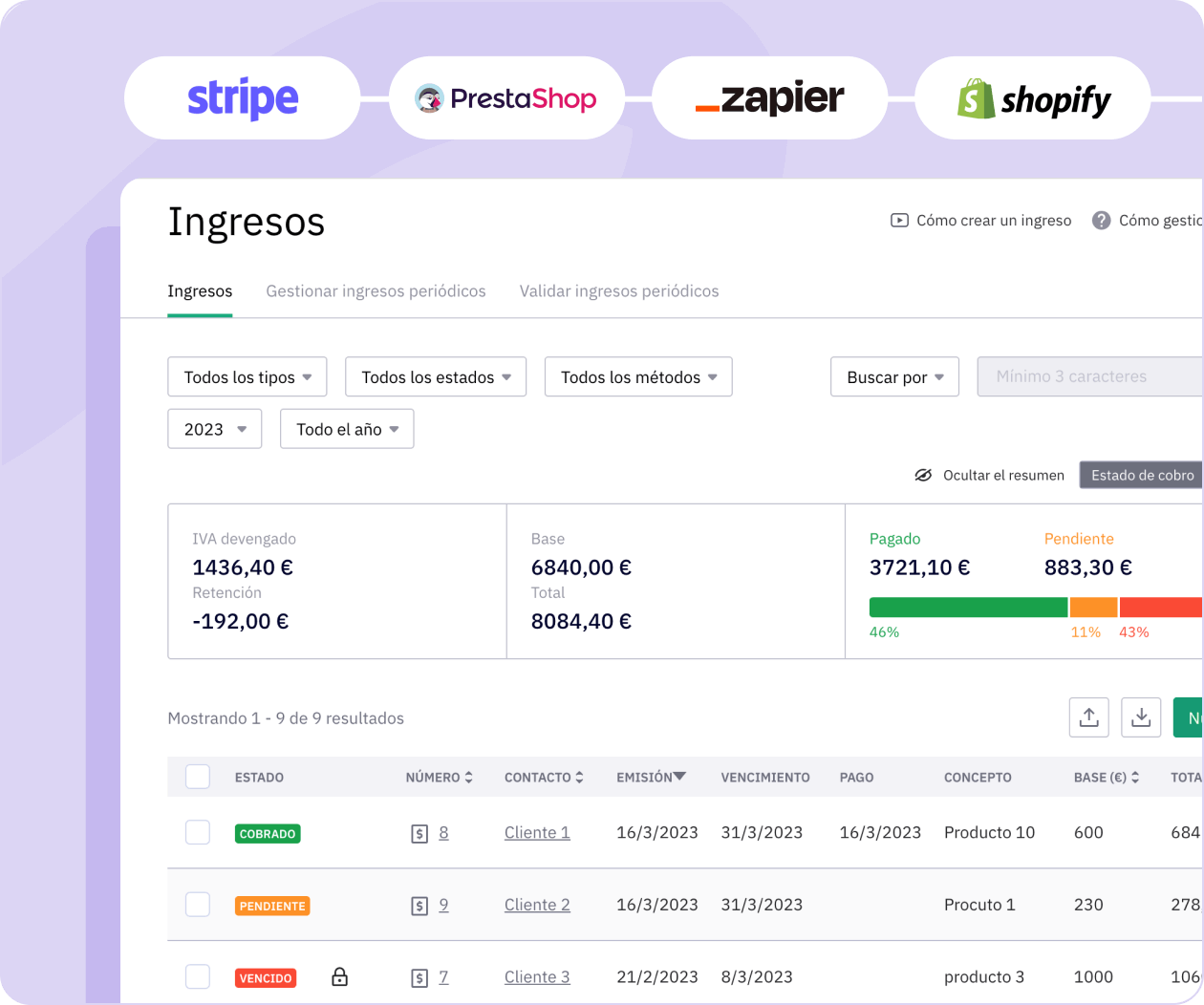

+200 Integrations available

Convert orders, delivery notes, quotations to invoices and manage your sales process from a single dashboard

Excel alternative

Easily import your previous invoices and start invoicing

Generates any type of document

Recurring invoices, rectifying invoices, pro forma invoices and receipts

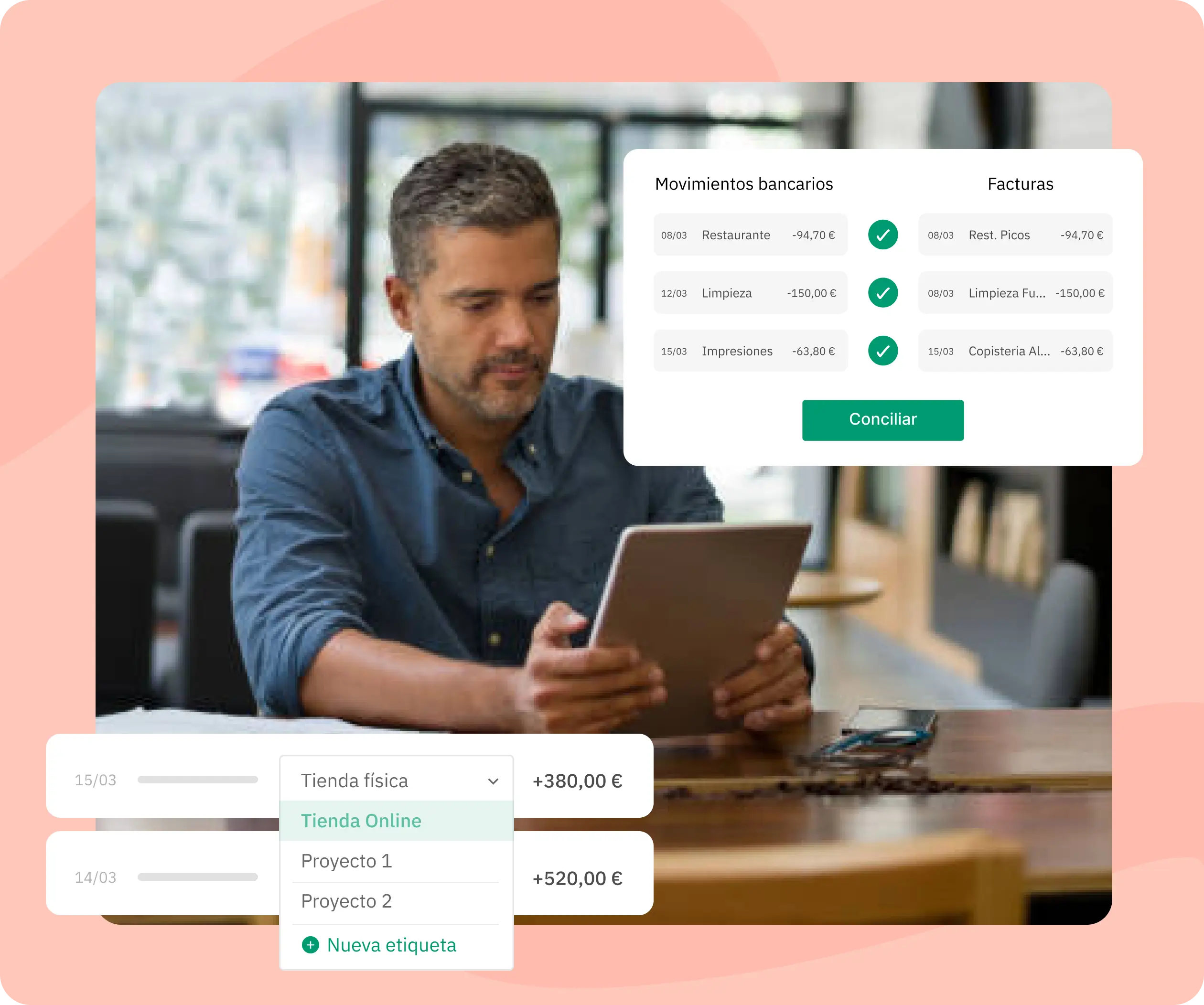

Automatic bank reconciliation

We automatically assign your invoices to the corresponding bank transactions

Categorización analítica

Clasifica tu facturación con etiquetas o analítica para detectar oportunidades de negocio

We want to accompany you in the growth of your business. Do not hesitate, we will inform you without obligation.

Get detailed answers to frequently asked questions about the platform.

Request specific information or find out everything you need to know about Quipu in a demo.

The invoice is practically the most important document of our invoicing. It is the key point of our economic activity, to justify the expenses and the incomes that you have had during quarter and at the end of the year.

You must bear in mind that nowadays the "tickets of all the life" are also called rectifying invoice. But it is NOT an invoice, for the simple reason that it does not have the fiscal information of the issuer and the receiver. A ticket, or simplified invoice only consists with the NIF of the issuer, therefore, if we want to deduct an invoice we will not be able to because it will not contain our name and our fiscal information.

If you already know how, create a free invoice by entering our invoice generator now, if not, you can continue reading. From here, it is very important to know perfectly how to make an invoice and thus not to have problems when sending all our information to Hacienda.

It is very important to know how to make an invoice and thus not have problems when sending all our information to the IRS. You have many options to make an invoice.

The simplest way is to establish a template with different fillable fields that allow you to write and change the information depending on the client. Previously they were done by hand and with paper, nowadays there are different ways, but with the application of new technologies it is increasingly easier to make them and send them.

There are some that are even a barbarity in design! Keep in mind that the logo and the structure are customizable as long as they contain all the data we have specified throughout this article. Another easier and more convenient solution are invoice generator applications, such as Quipu.

Where the templates are already made and you only have to fill in the default fields. This allows you to create invoices quickly and easily without forgetting any mandatory fields.

1. Numbering.

So easy as to have order at the same time. We have to number them so that we know which one is which, without repeating, obviously. You can start with 40 or 1, but never repeat them and above all, with correlative numbers. That is to say, after the 1 goes 2 and not 4. one after the other: 40, 41, 42,...

2. Date of issue.

The day we create it. If, for example, you get paid at the end of the month and we make an invoice for the month of June: the issue date will be June 30, 2021.

3. Expiration date.

In other words, "the day that invoice expires". Until what date we have to proceed to payment, or else to collection.

4. Tax Information.

Both yours and your customer's. As we mentioned before, this is the essential difference between an invoice and a ticket. The presence of the information of both parts.

- Your name or that of your company

- The Tax Identification Number for the company or the DNI in case of being freelance

- Address.

5. Concept and applied tax rates.

The reason for the operation, the description, the service. For example, consulting services, sale of commercial material, etc.. with all the important parts of the price:

- The taxable base: amount without VAT.

- The VAT, tax rate applied: 4, 10 or 21%.- Discounts if any, should also be reflected.

- As well as the IRPF retention, if we apply retention.For example, we present our client with an invoice for marketing services in its new web design. The invoice amounts to 650€ -taxable base- and we apply a 21% VAT plus 19% IRPF, the invoice will end up being 728€ added the different parts, but we always specify each point.

Calculate automatically the amount to invoice, with the invoice generator If there is no VAT, we must specify why. If there are different concepts, separate them from each other, as well as all the taxes applied broken down by tax rate.

6. For companies.

You must show the information of the record. The folio, the page, the volume...