Your time, energy and focus dedicated to the activity of your business

Manage your business more easily and without worries with Quipu, the invoicing software for freelancers

Manage your business more easily and without worries with Quipu, the invoicing software for freelancers

Quipu is the "all-in-one" program to centralize your information and know the status of your business

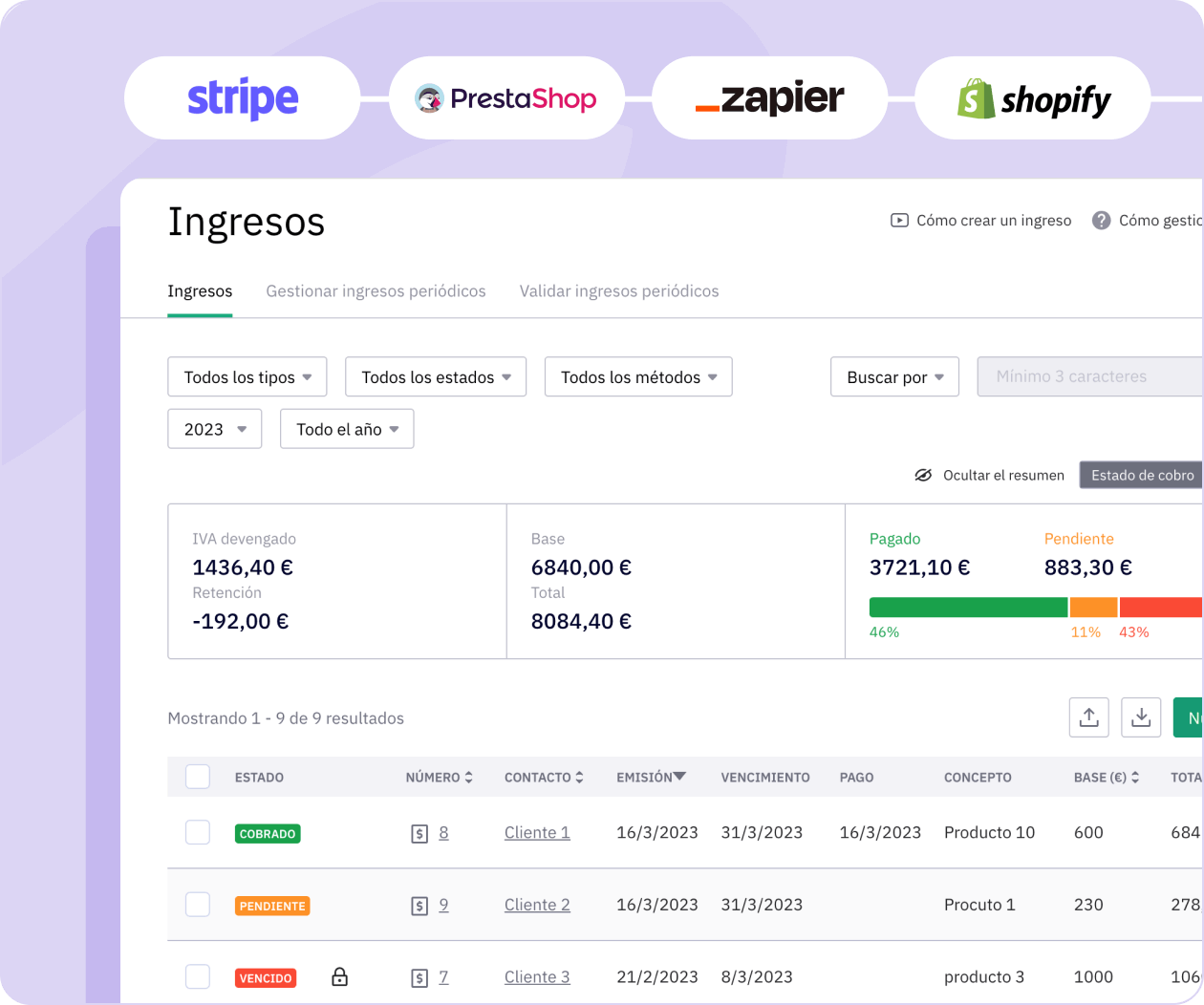

Easily find out who owes you money and to whom you have outstanding payments

Integrate your Quipu account with Stripe, Paypal, Prestashop, Zapier and other platforms

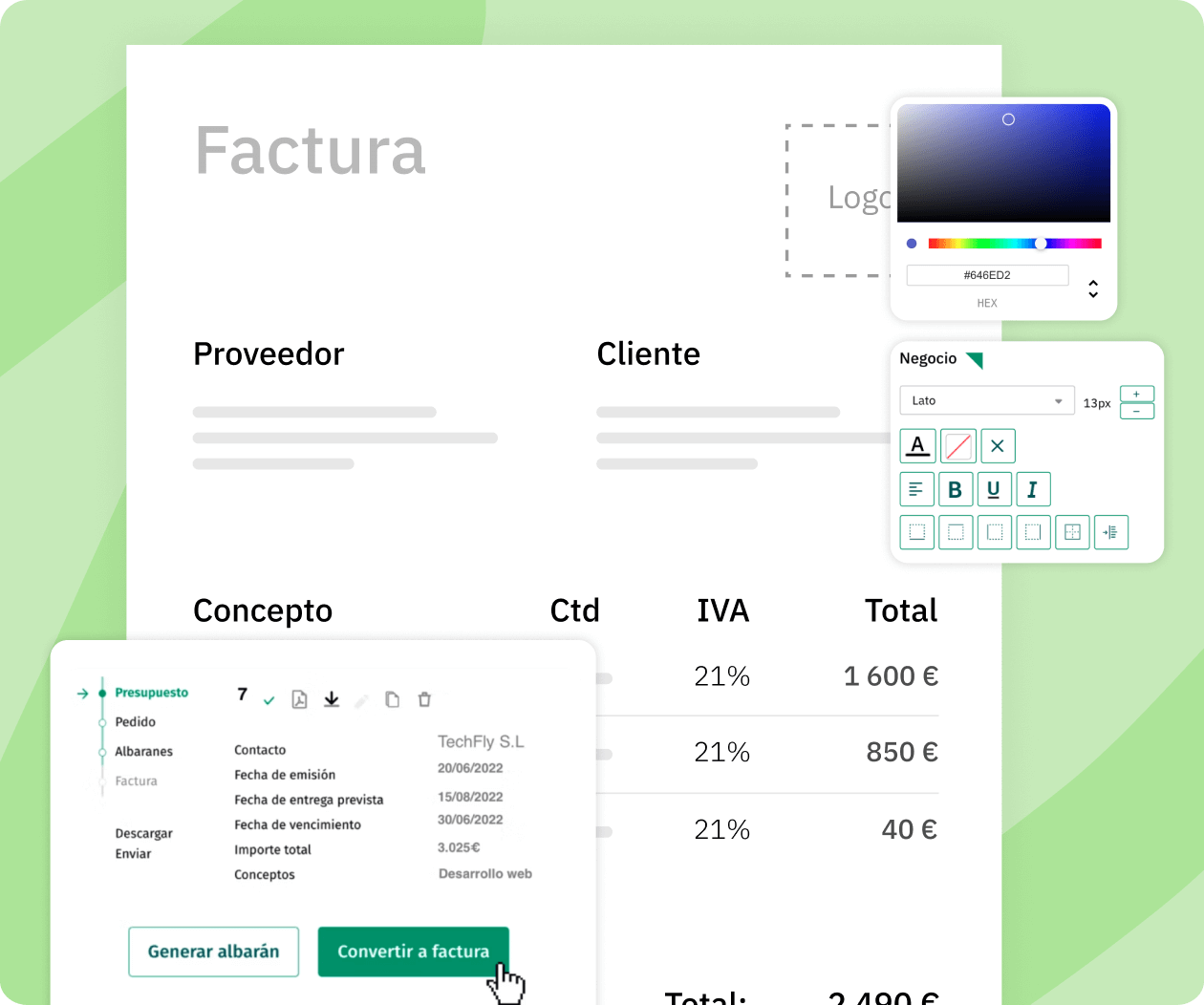

Convert orders, delivery notes and quotations into invoices and manage your sales process from a single dashboard.

Easily import your previous invoices in excel and start invoicing with agility

We adapt to your style, complying with tax regulations.

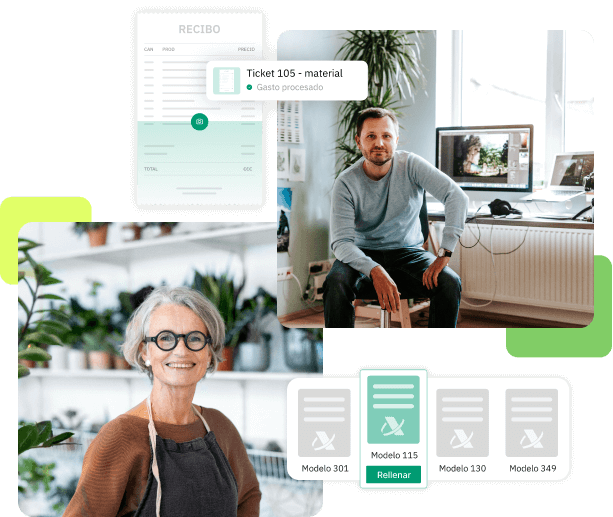

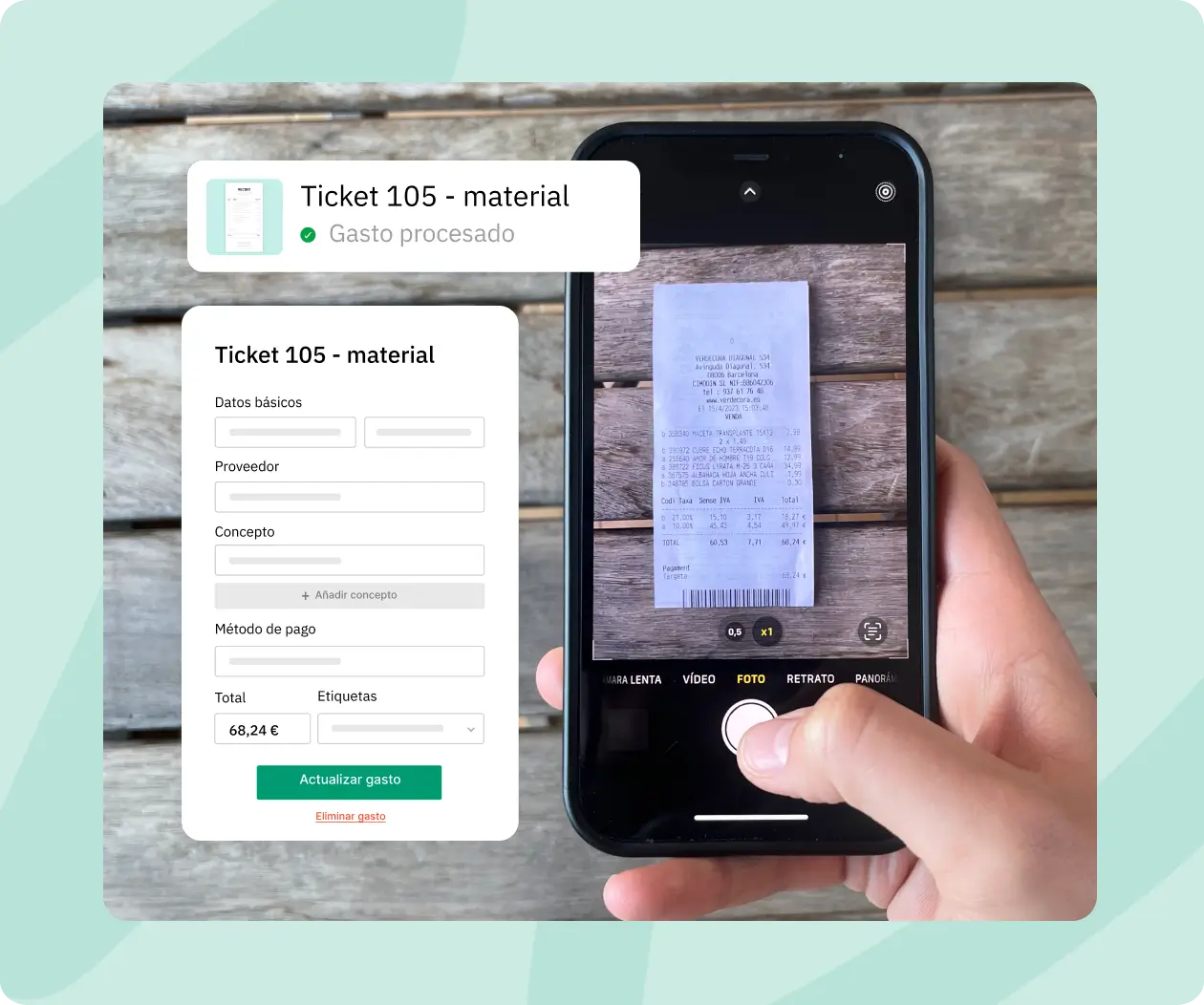

Forget about manually entering invoices and tickets

Your documents digitized and validated by our team in less than 24 hours

Manage your expenses from anywhere

The solution to deduct all your receipts and invoices

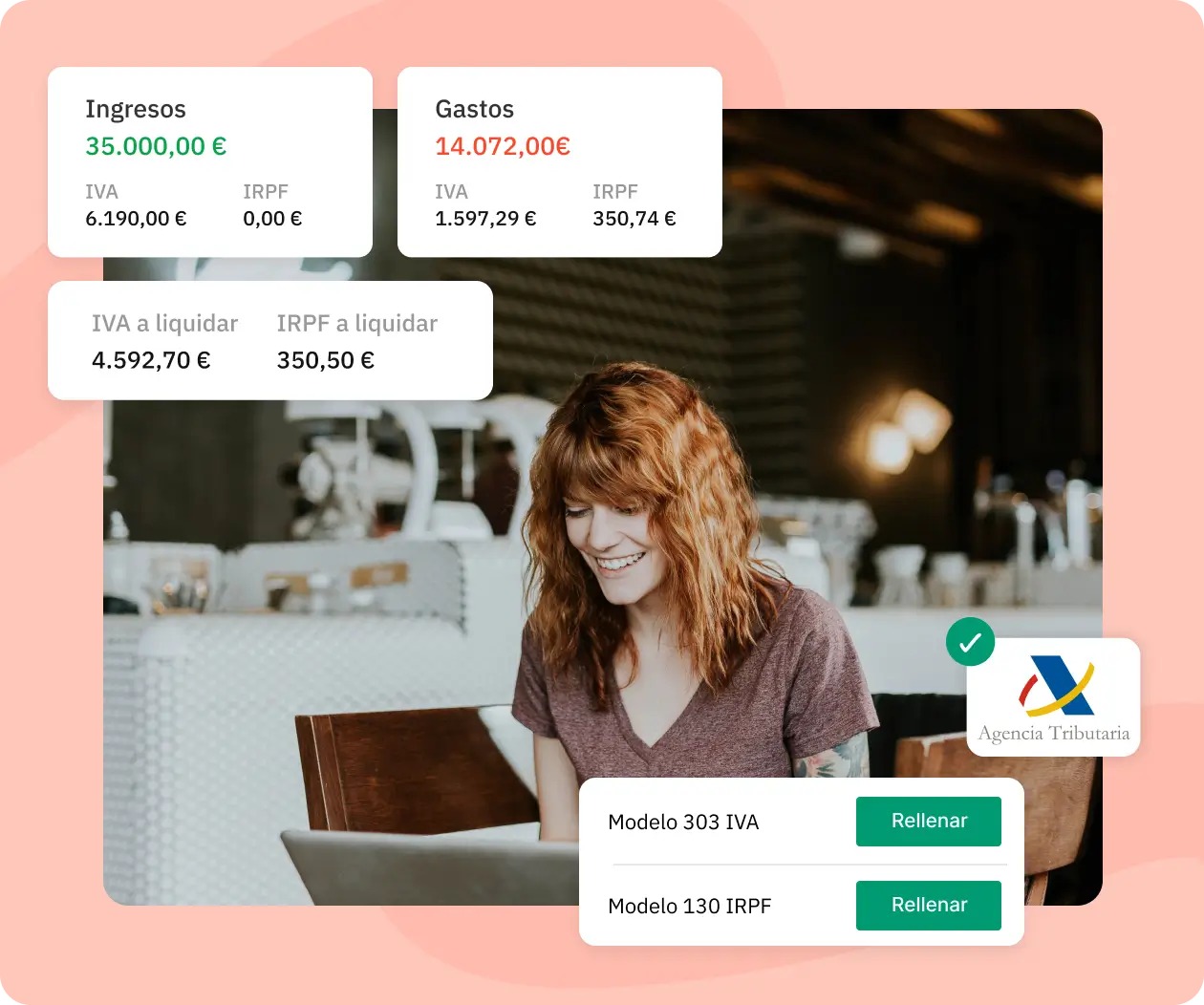

We calculate taxes for you

Tax Forms: 303, 130, 111, 111, 115, 349, 180, 190, 347 and 390

VAT and income tax to be settled forecast

Know what impact any income or expense will have on your liquidation in real time

Dedicate your time and effort to your business activity by automating tasks

The management of your business in one place to have all the information at your fingertips

Track the status of your business from the mobile application

All the data you need at your fingertips in just a few clicks

Save your invoices in Quipu for the mandatory 4 years, saving physical space

Connect a manager to your Quipu account to validate all your documents

"I would highlight the help with the filing of tax forms: no more hellish headaches in front of the computer."

Maria Moreso

Graphic Designer

"The entire data migration has been quick and easy with the help of the technical support, either via phone calls or chat.

Jan Navalls

Brava Towels Founder

"Being able to see several months ahead the available liquidity has been crucial to ensure the continuity of my business with peace of mind.

Aida López

AK Studio Founder

With Quipu's invoicing software you can easily import data from past quarters.

The process is super simple and totally free! All you have to do is export them in Excel and transfer them to our information template in the same format.

With Quipu, you can manage a wide variety of documents, such as:

Ordinary invoices:

These are documents that reflect the cost of the products or services that have been acquired. They must include a series of mandatory data such as: detailed information of each product or service, taxes, withholdings, fiscal information of the issuer and receiver, numbering and series, etc.

Tickets or simplified invoices:

Unlike ordinary invoices, these are documents in which the amount of detail on the products and services that have been acquired is less.

Recurring or periodic invoices:

These are invoices that are issued periodically to reflect the cost of services or products that are sold on a regular basis, such as, for example, the rental of premises or the subscription to a service.

Corrective invoices:

These are invoices that are issued to correct errors or modifications in previously issued invoices. Corrective invoices must include information about the original invoice and the corrections made.

Estimates:

These are documents that reflect an estimate of the costs of a product or service. Estimates usually include detailed information on the price of each product or service, the corresponding tax and the total to be paid.

Proforma invoices:

These are invoices issued by companies to reflect the cost of a product or service that has not yet been sold. Proforma invoices usually include detailed information on the product or service, the price and the corresponding taxes.

Purchase orders:

These are documents that reflect a customer's request for the purchase of a product or service. Orders should include detailed information about the product or service requested, the price and the delivery time.

Delivery notes:

These are documents that reflect the delivery of a product or service to a customer. Delivery notes include detailed information about the product or service delivered, the price and the place of delivery.

Payrolls:

These are documents that reflect the net and gross salary of an employee and that in Quipu are part of your expenses.

Yes, you can give access to your advisor or manager by creating an extra user and assigning the permissions and roles you prefer. You can consult in more detail in this link.

If you still do not have a bookkeeper or you want to work with one of Quipu's +500 certified advisors, you can consult the following link.

Of course!

In Quipu this step is very simple since you just have to enter the "Income" section of your account, look for the invoice you need to rectify using the different filters and once located, click on the three dots on the right and select the option: "Create rectifying invoice".

You can request a demonstration at the following link.